Case Studies

Due Diligence/Investment Review

Generating and Power Development Company and Canadian-based Pension Fund

Objective

A large Canadian-based pension fund engaged Access Capital as a financial advisor to review a potential investment in an electrical generating company (subordinated debt and equity).

Access Capital Solution

Access Capital was asked to review the operations and prospects of a stock exchange-listed generating and power development company. After reviewing the risk/return profile, Access Capital concluded the investment leaned too heavily towards the risk side of the scale giving several concrete reasons for its decision. Access Capital recommended against proceeding with the investment despite a good deal of pressure from both investee and investor.

Result

Two of the three reasons for the declined investment came to fruition thereby validating the recommendation and saving the investor from losing approximately 40% of its investment.

Corporate Finance/Divestiture/Value Maximization

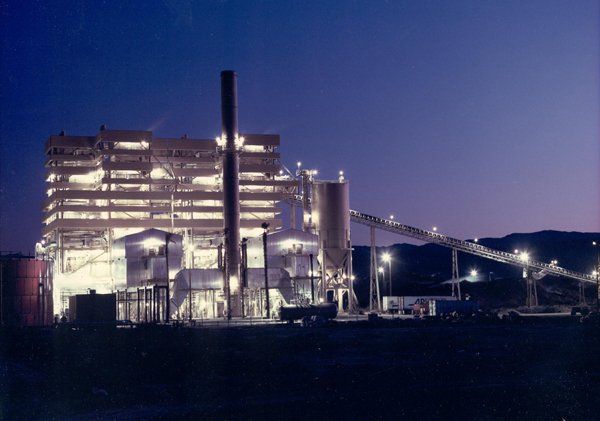

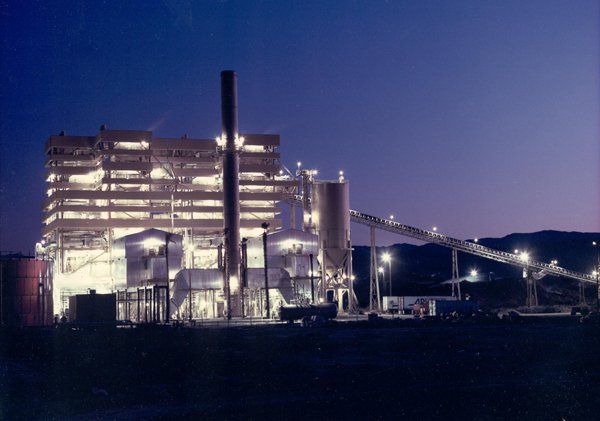

A Large Electricity Generator

Objective

Access Capital was asked to value a client’s interest in a gas-fired cogeneration asset.

Access Capital Solution

Access Capital was asked to value this asset using traditional valuation methodology. Using this traditional valuation methodology, Access Capital valued the asset at $x. Upon further review, Access Capital’s analysis indicated that another valuation methodology should be utilized.

Result

Access Capital was able to obtain 3 times the traditional price valuation upon the sale of the asset for the client. This sale took place less than 10 weeks after appropriate identification of the deal components.

Development/Lender Advisory Role

Hydro Development Project

Objective

A hydro project developer engaged Access Capital to assist in confirming the project economics and to determine the small hydro project value (less than 25 Mw).

Access Capital Solution

The developers did not have adequate equity funding to allow them to complete the project on their own. Therefore, Access Capital assisted the developer through various stages of development – most importantly by bringing the right equity partner into the equation. Access Capital did so to its own detriment since the new partner offered many of Access Capital’s services, namely project financing. Since Access Capital was thereafter denied the financial advisory role, Access Capital partnered with an insurance company to mount an aggressive winning bid out of a field of three candidates.

Result

Access and its lenders closed the financing in a timely fashion at a low cost. Access Capital acted as the leading syndicate advisor and loan administrator throughout the construction phase of the hydraulic project.

Equity Investor Advisory Role

Multinational Energy Firm

Objective

Access Capital advised a large multinational on the purchase of a minority interest in an operating gas-fired power project.

Access Capital Solution

Access Capital’s diligence and persistence on behalf of the multinational secured a lower than expected purchase price for the gas-fired power project. Access Capital was so determined in its pursuit of value for the multinational that an Access Capital team member won the transaction’s “MVP” award.

Result

Upon deciding to sell its interest in the asset, the original vendor selected Access Capital to act as its financial advisor. Access Capital helped the client obtain this particular asset at an attractive price. Within 2 years, the market had turned and the client was looking to sell the asset and take their profits.

Because of Access' industry knowledge and straight forward approach Access was chosen by the client to act as its divestiture advisor.